Table of Content

Allstate has a rich and long history in many insurance markets. They have a lot of experience under their belt and surely know their way around the industry. With more than 113 million policies set across the country, Allstate is known to be one of he best mobile home insurance providers across the US. Personal property coverage compensates for any personal belongings inside the property that may have been damaged. More often than not, these are controlled at a certain percentage by your dwelling coverage limit.

Replacement cost covers any damage incurred on your mobile home, personal property, and/ or other structures. There are 4 main coverage features that are crucial to the foundation of a sound mobile home insurance policy. When considering different options, ensure that each and every one of the following are included. However, it usually requires a unique form of insurance rather than a standard homeowners insurance policy since it has significant structural differences.

American Modern (AMIG)

If you are underinsured, consider that a catastrophic loss may not be covered. An annual cost of $603 is substantially higher than our current insurance policy of only $230 per year but it covers a lot more with a lower deductible and allows us to have a wood stove. There are some fantastic mobile home insurance agents out there that will help you find the best coverage for your specific needs. As different mobile home insurance companies use different methods to calculate your rate, it’s a good idea to shop around to find the most competitive rate. Progressive offers discounts geared specifically for new homeowners.

We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Many insurers also offer discounts for having a home security system, smoke alarms or other protective devices. Home insurance policies typically don't cover “earth movement." Manufactured and mobile homes typically need a different type of insurance than site-built homes. Pays for covered repairs or replacement of the dwelling and other structures on the same property, such as sheds and garages. If you’re looking to protect a manufactured home, Progressive should be one of your first stops.

Farmers

Other optional coverages include ones for hidden water damage, debris removal, and matching siding endorsement if only part of your mobile home’s wall is damaged. Owning a mobile home has special considerations that are different from those involved with owning a traditional home, such as qualifying for an insurance policy. Luckily, there are separate mobile home insurance policies that offer protection against certain types of vulnerability, such as windstorms and water damage. Allstate offers specialized coverages for your mobile home, such as personal property endorsements for higher-value items, green improvements reimbursement and sports equipment. If you already have other Allstate policies, you'll receive a multi-policy discount, as well as original owner, retired individual or security system discounts. The cost of your mobile home insurance will vary on multiple factors relating to your property, location, and the coverage policies you acquire.

Provides additional coverage for expensive items such as appraised jewelry, collectibles or antiques. The American Family Insurance only underwrites manufactured homes in 19 states but provides unique endorsements such as matching siding. The coverage costs as little as $25 per year but will reimburse you for up to $20,000 to replace all siding, instead of a small area, so it all matches. Below, we’ve listed some of the best picks so you can shop, compare and find the best mobile home insurance for your needs. If you choose to bundle your mobile home and auto insurance policies, you can save up to 25% on your premium.

What are the best mobile home insurance companies?

GEICO has no control over the privacy practices of the company mentioned above and assumes no responsibilities in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website. Do you think your home is safe from flooding because you don't live near the coast? Floods can occur anywhere and outside of high-risk flood zones. For all other policies, log in to your current Homeowners, Renters, or Condo policy to review your policy and contact a customer service agent to discuss your jewelry insurance options.

Progressive’s coverage includes protection for your dwelling in case of fire, hailstorm, theft, vandalism, explosions, and other covered perils. It also includes actual cash value for personal property, loss of use coverage, and liability coverage. Homeowners can also add on trip collision coverage and replacement cost coverage, though these vary from state to state. Mobile home insurance is also known as manufactured home insurance, depending on the policy and type of home, and is much like any other homeowners insurance policy. It covers the dwelling, your personal property and offers liability protection. These coverages can be accessed during a claim from a wide range of covered events or perils, such as a fire, snowstorm, severe thunderstorm, burglary or theft.

Since mobile homes are brought to various locations, sometimes parked in campsites or trailer parks, there is a higher risk of theft. Skirting is made out of either vinyl or brick and is used to cover the bottommost part of your mobile home. This is in order to efficiently insulate pipes and also keep stray animals out.

When selecting a limit for this part of your policy, you want an amount high enough to replace your mobile home if it’s destroyed. Consider buying extended replacement coverage, which will give you a cushion in case rebuilding costs more than you expect. It’s difficult to nail down an average price of homeowners insurance, but for a standard home in a standard part of the country, you can expect to pay between $100 and $150. The first thing to understand is that there is no “typical” homeowners insurance policy. Each individual’s situation is unique, their tolerance for risks will vary, and their policy will be written based on a huge number of variables.

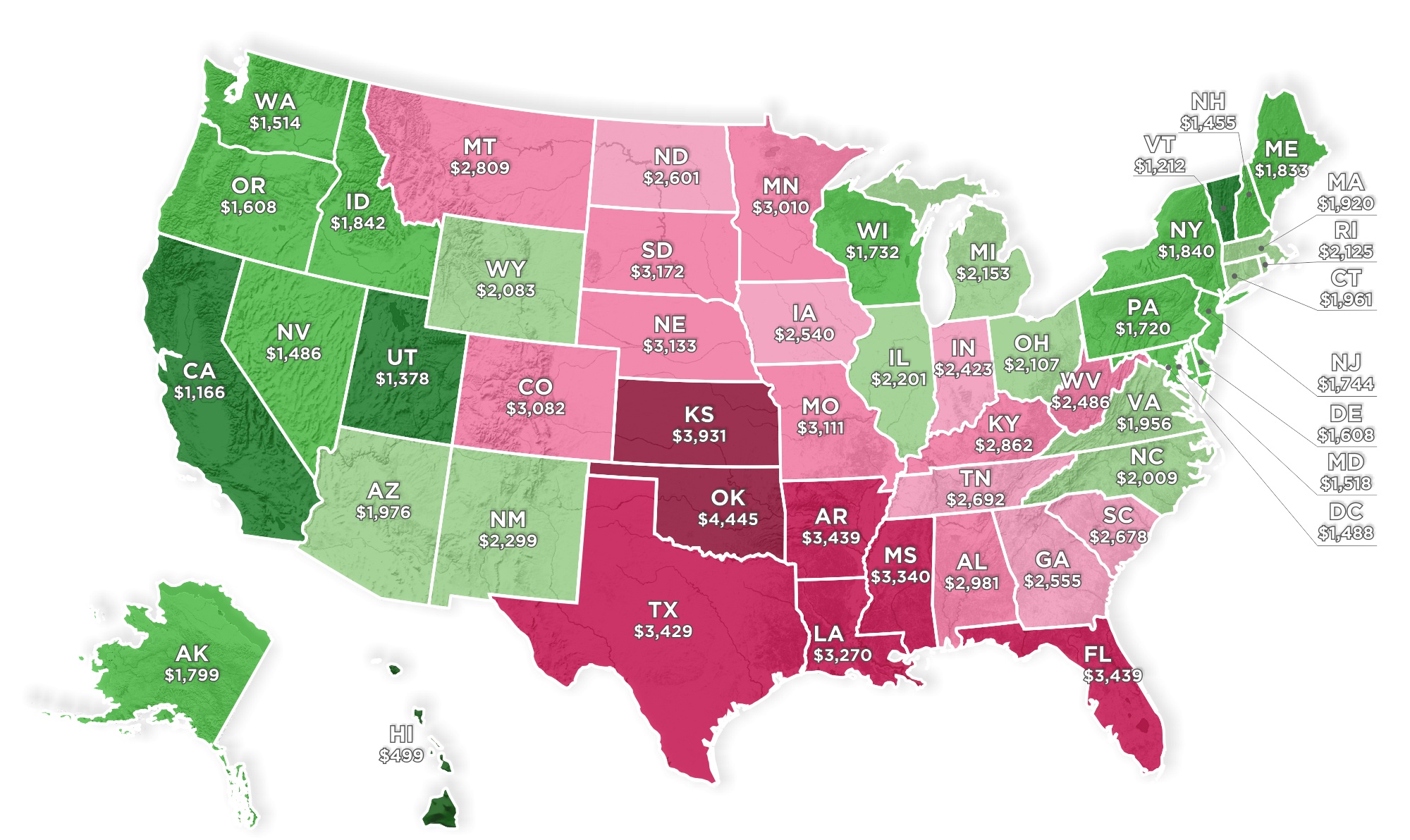

And, don’t worry, just like the best home security systems on the market today, there are plenty of insurance options for mobile home owners. Below is a chart depicting the average insurance rates per state by StaticBrain. Insurance companies usually have products with minimal coverage to those that are fully loaded. How long has the company been providing manufactured home insurance? Even though a company boasts of a long history in the insurance industry, this is a niche market and requires experience. It must be that time we are not in the office and you need an insurance quote immediately.

Farmers structures its mobile home policies to give you options on how you'll get paid in case of property losses or damages. With an agreed-value loss settlement, you'll receive the full amount of insurance as a lump sum to rebuild or order a new home faster. Add optional replacement cost coverage, and you'll get the cost of replacing items with new ones, instead of receiving the item's depreciated value. Whether you live in a traditional or manufactured home, homeowners insurance prevents you from being financially overwhelmed if disaster strikes. Now, it depends heavily on which protections you select from which provider, but generally speaking, there are six categories of coverage offered by a standard policy. When comparing policies, make sure to look at the basis of any claims settlement, such as named or open perils and whether it’s actual cash value or replacement cost.

However, you can expect your mobile home insurance policy to be lower since it usually requires significantly lower dwelling coverage limits than regular homeowners insurance. Foremost offers comprehensive property cost coverage, personal liability, and property coverage, and extras such as food spoilage, additional living expenses, and locksmith coverage. Add-ons include earthquake coverage, water damage, identity fraud expense, and trip coverage when your home is being transported.

Because a hobby farm or ranch has potential legal exposure to your mobile home, it would be wise to have coverage for it. This would be useful in situations wherein someone falls ill eating your homegrown food, and similar events. Additional structure coverage compensates for any damage incurred on the adjacent or separate structures of your mobile home, such as your garage. When most people think of manufactured homes, they usually picture something similar to the metallic trailers that were popular in the 50s, 60s, and 70s.

Flood damage is not traditionally covered by the average homeowner’s insurance policy. However, most mobile homes usually qualify for this due to the nature of their structure and vulnerability to harsh environments. As a result, it outperformed all other companies in our in-depth review, scoring a 4.84 out of 5.

No comments:

Post a Comment